News

OCCH Closes New $312 Million Fund, the Largest Capital Fund Raised to Date

November 25, 2019

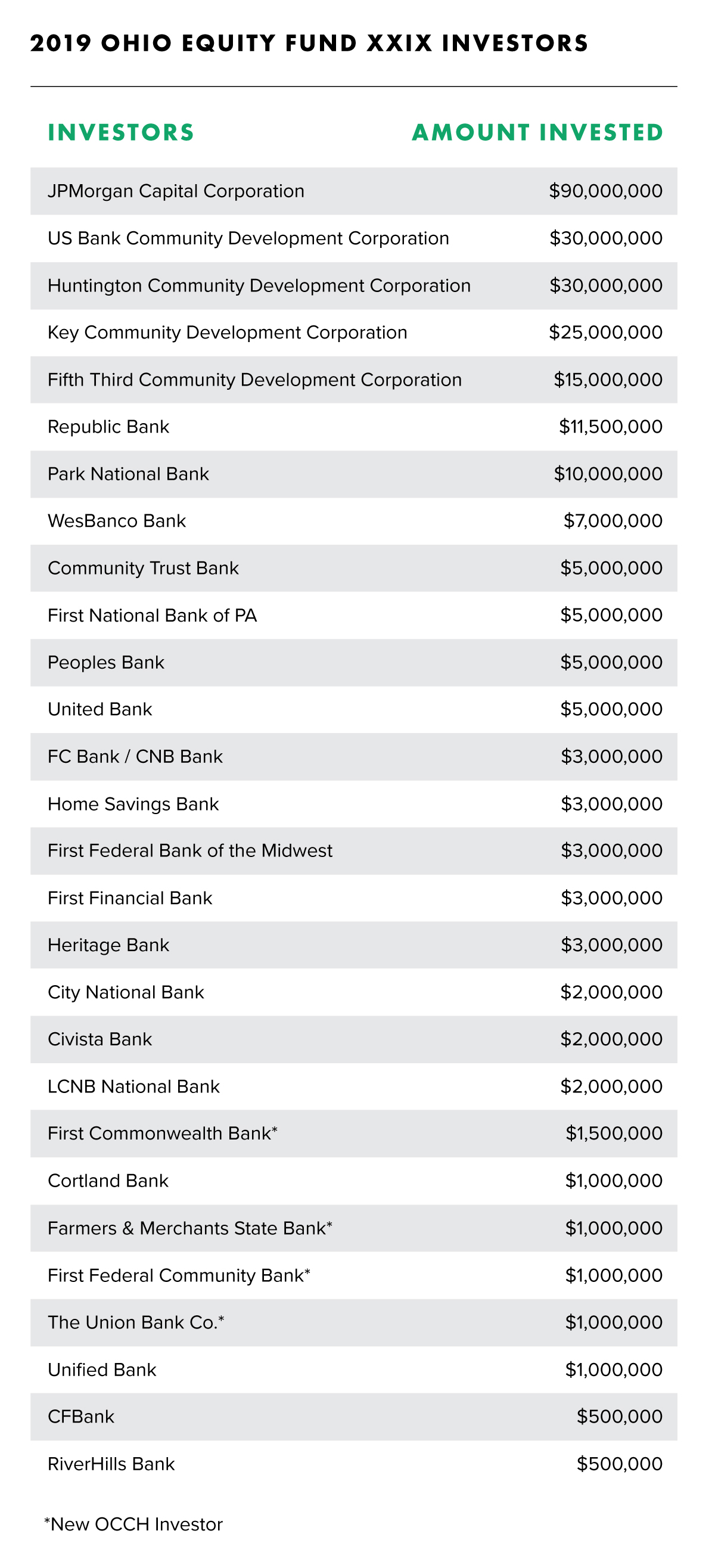

OCCH closed its largest equity fund to date – having secured $312 million in commitments from 29 investors, including 4 new investors. With this record closing, OCCH has now raised over $4.5 billion in private equity investment, financed more than 47,750 affordable housing units, and assisted in the creation of 840 affordable housing developments for families, seniors, and special needs populations.

“OCCH is fortunate to retain, grow, and work side-by-side with our investment partners who continue to provide great economic impact and opportunity to low income families and individuals in rural, urban, and suburban neighborhoods,” said Peg Moertl, OCCH president. “With this massive investment, our partners will continue to preserve and create much needed affordable homes that make a difference to the quality of life in our communities.”

Ohio Equity Fund for Housing (OEF) XXIX will provide over 3,000 units of affordable housing in 42 projects, enlarging OCCH’s footprint in Ohio, Kentucky, West Virginia, Pennsylvania, and Tennessee. The fund includes a record $90 million investment from JPMorgan Capital Corporation.

“This record fund is significant not only for its size, but also for the impact it will create with our residents and communities. Ten investors have selected to commit a percentage of their equity investment to OCIC, an OCCH affiliate that administers philanthropic activities that benefit OCCH residents and neighborhoods,” said Jon Welty, Vice President, OCCH. “With this capital, OCCH will continue to preserve and create much needed affordable housing while also creating educational and economic opportunities for our residents.”

The investors that comprise OEF XXIX include the following financial institutions: